(VAN) India’s re-entry disrupts Pakistan’s rice exports, intensifies price competition.

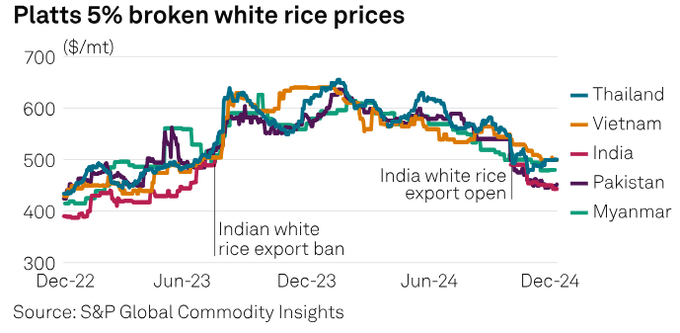

India and Pakistan, both leading rice exporters, are locked in intense competition to dominate key global markets, with Pakistani and Indian 5% broken white rice (WR) prices dropping to multi-months low.

Pakistan and India are two of the most competitive markets regionally. Platts assessed Pakistan 5% broken WR prices at their lowest in 19 months at $452/mt FOB, while India 5% broken WR prices have also slumped to an 18-month low of $443/mt FOB on Dec. 10.

Currently, India holds the title of the world’s largest rice exporter, with Thailand, Vietnam, and Pakistan ranking next in line.

As for other Asian origins Platts assessed prices for Vietnamese origin at $499/mt FOB on Dec. 10; Thai at $500/mt FOB; and Myanmar at $480/mt FOB FCL, S&P Global Commodity Insights data shows.

India’s re-entry disruptive for Pakistan

Demand of Pakistani rice has been subdued as India is back in the game. Pakistani sources said that demand is likely to shift back to India, especially for price-sensitive regions like West Africa. According to market participants, West African buyers are holding off on purchases ahead of Ramadan — starting at the end of February 2025 — planning to source from the cheapest supplier.

Last year on July 20, India imposed a ban on the export of white rice. On Sept. 28, 2024, the country lifted the ban on non-basmati white rice exports but introduced a minimum export price of $490/mt. Subsequently, on Oct. 23, 2024, the Ministry of Commerce and Industry announced the removal of this minimum export price for non-basmati white rice.

India’s re-entry recently has resulted in significant price drops across all origins, with Pakistan facing the toughest competition due to Indian pricing. Additionally, Pakistani market participants also reported renegotiation of previously made deals for shipments booked before India’s export reopening.

A Karachi based exporter said: “Prior to India’s approval of exports, contracts were at higher rates; however, by the time shipments were executed, the market had dropped by at least $100/mt. This situation led to reports of renegotiations and the finalization of deals. The downward pressure on prices in Pakistan is becoming apparent.”

Despite the competitive pressure from India, some market analysts believe that Pakistan may still maintain a slight edge in pricing. Another Karachi-based exporter said: “Pakistan is likely to settle at a premium of $10-15/mt over Indian rice, but price-sensitive regions may be lost to India. Freight rates will play a crucial role as buyers consider the final price, particularly given the recent volatility observed in freight rates to major destinations. Additionally, markets like China and the Philippines, which favor specific quality rice, may accept a $10-$15/mt premium for Pakistani rice, but not more.”

Meanwhile, Pakistani suppliers are trying to navigate internal challenges too, as the market tries to adapt to the new reality. A Dubai-based trader said: “There is enough stock available, but demand for rice is very quiet nowadays as buyers are also in a wait-and-hold mode while prices to settle. In Karachi, Pakistani exporters are facing high duties, which complicate their business operations. The situation at the ports is challenging, with significant backlogs due to ongoing short covering. Additionally, the liquidity position is strict, adding to existing challenges.”

Other sources said rice prices might fall further. All origins have witnessed bearish trends as India’s entry shifts demand and increases global supply.

A Pakistani market participant said: “The market is expected to go down further, to prices before COVID levels. By January-February, all origins might face bearish trends. India’s entry has significantly changed market dynamics, as buyers are swiftly shifting to India. Additionally, world supply will increase significantly as the new crop from India pushes into the market.”

Meanwhile, some Indian exporters feel confident in India’s competitive pricing and export potential, which may make it challenging for Pakistan to compete effectively in the market. Overall, there is a mix of optimism and concern among exporters regarding the evolving trade dynamics.

“The situation at Kakinada port has become increasingly problematic as the government has begun seizing cargo, alleging that rice intended for the Public Distribution System (PDS) has been illegally diverted for export. The situation is prompting exporters to avoid Kakinada, with cargoes increasingly being redirected to Kandla port. This shift is likely to result in a substantial decline in trade through Kakinada,” Dev Garg, Vice President of Indian Rice Exporters Association, said.

Garg added that although India has surplus food grain stocks sufficient to cover the current export gap, a shutdown of Kakinada port would lead to congestion, delays in shipments, increased freight costs, and reduced export volumes. This could even result in some trade being diverted to Pakistan, particularly for bulk shipments.

“Bulk shipments from Kakinada and Vizag ports are currently being disrupted due to cargo seizures by officials. If Indian prices decline, Pakistani prices are likely to follow suit. With the reopening of Indian exports, Pakistan has started offering discounts and renegotiating contracts to stay competitive. However, India’s vast export potential and lower prices give its exporters an advantage, making it difficult for Pakistan to compete in the export market,” an India-based exporter said.

India is forecast to export 20.5 million mt of rice in the marketing year 2024-25 (October-September), up 42.36% year over year, while Pakistan’s rice exports projection in the marketing year 2024-25 (January-December 2025) is 5.7 million mt, down by 12.3% on the year for 2024-25, as per Commodity Insights data.

Agriculture News | Agri Products Price